Unknown Facts About Bankruptcy Attorney Tulsa

Table of Contents5 Simple Techniques For Tulsa Bankruptcy AttorneyAll About Tulsa Bankruptcy ConsultationThe Buzz on Affordable Bankruptcy Lawyer TulsaThe Definitive Guide for Chapter 7 - Bankruptcy BasicsAn Unbiased View of Tulsa Bankruptcy Filing Assistance

The stats for the other major kind, Phase 13, are even worse for pro se filers. Suffice it to state, talk with a legal representative or two near you who's experienced with personal bankruptcy regulation.Lots of attorneys likewise use cost-free appointments or email Q&A s. Take benefit of that. Ask them if personal bankruptcy is without a doubt the best selection for your circumstance and whether they believe you'll qualify.

Ads by Cash. We might be compensated if you click this advertisement. Ad Now that you have actually made a decision bankruptcy is indeed the best strategy and you ideally removed it with an attorney you'll need to obtain started on the documents. Prior to you study all the official personal bankruptcy types, you need to get your own documents in order.

Bankruptcy Attorney Near Me Tulsa - The Facts

Later down the line, you'll really require to confirm that by divulging all kind of details concerning your monetary affairs. Below's a fundamental listing of what you'll need when driving in advance: Determining files like your vehicle copyright and Social Safety card Income tax return (up to the previous 4 years) Proof of income (pay stubs, W-2s, freelance earnings, earnings from properties as well as any type of revenue from government advantages) Financial institution statements and/or retired life account statements Proof of worth of your properties, such as automobile and realty assessment.

You'll intend to comprehend what type of financial obligation you're attempting to fix. Debts like youngster support, spousal support and certain tax financial debts can't be discharged (and personal bankruptcy can not halt wage garnishment associated to those debts). Student finance financial debt, on the other hand, is possible to discharge, yet note that it is tough to do so (Tulsa bankruptcy lawyer).

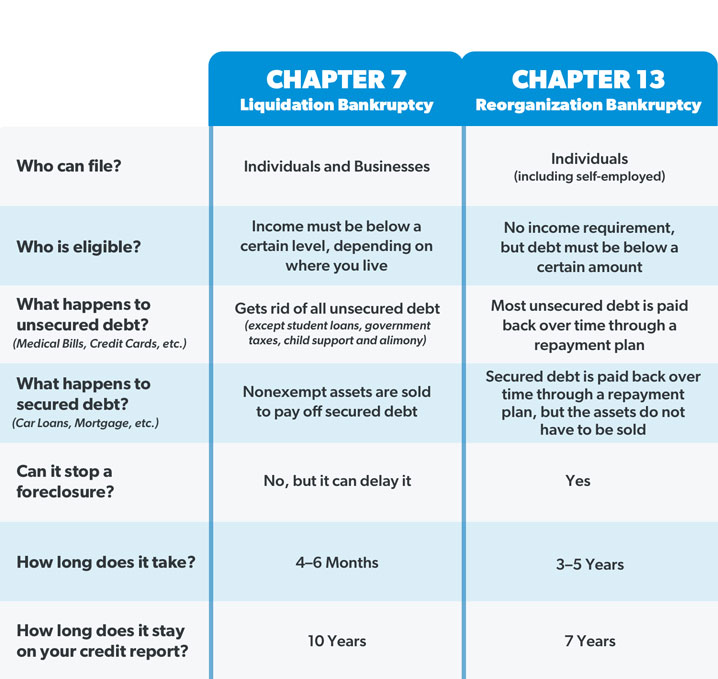

You'll intend to comprehend what type of financial obligation you're attempting to fix. Debts like youngster support, spousal support and certain tax financial debts can't be discharged (and personal bankruptcy can not halt wage garnishment associated to those debts). Student finance financial debt, on the other hand, is possible to discharge, yet note that it is tough to do so (Tulsa bankruptcy lawyer).If your earnings is expensive, you have an additional option: Phase 13. This choice takes longer to solve your financial obligations additional info because it requires a long-lasting settlement strategy normally three to 5 years before several of your staying financial debts are wiped away. The declaring process is likewise a whole lot more complicated than Chapter 7.

Some Known Details About Tulsa Bankruptcy Lawyer

A Phase 7 personal bankruptcy stays on your credit rating report for 10 years, whereas a Chapter 13 insolvency drops off after 7. Prior to you send your personal bankruptcy kinds, you have to initially complete a required training course from a credit therapy company that has been approved by the Department of Justice (with the noteworthy exemption of filers in Alabama or North Carolina).

The program can be finished online, personally or over the phone. Training courses generally set you back between $15 and $50. You should complete the training course within 180 days of declare bankruptcy (Tulsa bankruptcy lawyer). Utilize the Division of Justice's web site to discover a program. If you stay in Alabama or North Carolina, you need to pick and complete a program from a list of independently accepted suppliers in your state.

Some Known Details About Tulsa Ok Bankruptcy Specialist

A lawyer will usually handle this for you. If you're filing by yourself, recognize that there are regarding 90 different insolvency areas. Check that you're submitting with the correct one based upon where you live. If your irreversible house has actually moved within 180 days of filling, you should file in the district where you lived the higher part of that 180-day period.

Generally, your personal bankruptcy lawyer will certainly function with the trustee, yet you may require to send out the person papers such as pay stubs, tax obligation returns, and bank account and credit report card declarations directly. A common misconception with personal bankruptcy is that when you submit, you can stop paying your debts. While insolvency can help you wipe out many of your unsecured debts, such as past due clinical costs or personal car loans, you'll want to maintain paying your regular monthly settlements for secured financial debts if you want to keep the residential or commercial property.

Top Guidelines Of Top Tulsa Bankruptcy Lawyers

If you're at threat of foreclosure and have tired all various other financial-relief options, after that applying for Chapter 13 may delay the repossession and conserve your home. Eventually, you will still need the earnings to continue read this making future home mortgage repayments, as well as paying back any kind of late payments over the program of your layaway plan.

The audit could postpone any type of financial obligation alleviation by numerous weeks. That you made it this much in the process is a suitable indication at the very least some of your financial obligations are eligible for discharge.